san francisco gross receipts tax estimated payments

Gross Receipts Tax Rates. The current due date for the city of san francisco payroll expense tax and gross receipts tax statement is february 28.

Due Dates For San Francisco Gross Receipts Tax

Important filing deadlines include the San Francisco Gross Receipts filing deadline of February 28 and the April 1st business property tax filing.

. The effective date of this ordinance shall be ten days after the date the official vote count is declared by the Board of Supervisors. If approved you will have until may 6 2021 to pay your bill without incurring any late payment penalties However because the last day of. Estimated tax payments due dates include April 30th August 2nd and November 1st.

Third quarter 2016 estimated gross receipts tax installment Due October 31 2016. Residential landlords that rent four or more units with annual gross receipts less than 1090000 and payroll expense less than 300000 are. Quarterly estimated tax payments of the san francisco local business taxes that would otherwise be due on april 30 2020 by taxpayers or combined groups with combined san francisco gross receipts in calendar year 2019 of over 10 million still need to make these payments on time.

Payroll Expense Tax and Gross Receipts Tax returns due. What if i need to tax quarterly wage correction. Estimated business tax payments are due April 30th July 31st and October 31st.

San Francisco Gross Receipts Tax Anatomy Of San Francisco Now Fewer People Jobs Tourists Businesses But More Spending By The Hangers On But That Was Inflation Wolf Street. Every business with San Francisco gross receipts of more than 1090000 or payroll expense of more than 300000 is required to make three quarterly estimated tax payments and file an annual tax return. Payroll Expense Tax Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan.

Welcome to the San Francisco Office of the Treasurer Tax Collectors Business Tax and Fee Payment Portal. 10 Under current rules taxpayers may rely on 25 percent of their prior year business tax liability when making their estimated tax payments. E 0285 percent eg 285 per.

You may pay online through this portal or you may print a stub and mail it with your payment. In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date. Under the Existing GRT Ordinance the gross receipts tax applicable to the business activities of real estate and rental and leasing services is approximately.

There are two components to the tax and estimated payment a payroll tax expense and a gross receipts tax. The gross receipts tax rates vary depending on the type of business and the annual gross receipts from business activity in the city. You can file online with the City.

Quarterly estimated tax payments of the Gross Receipts Tax Payroll Expense Tax Commercial Rents Tax and Homelessness Gross Receipts Tax otherwise due on April 30 2020 are deferred for taxpayers with San Francisco gross receipts of 10 million or less measured using calendar year 2019 gross receipts. Use this TTX worksheet to help calculate your gross receipts tax for tax planning and installment payment purposes. The due dates for the city of san francisco payroll expense tax and gross receipts tax statement are the last days in april july and october respectively.

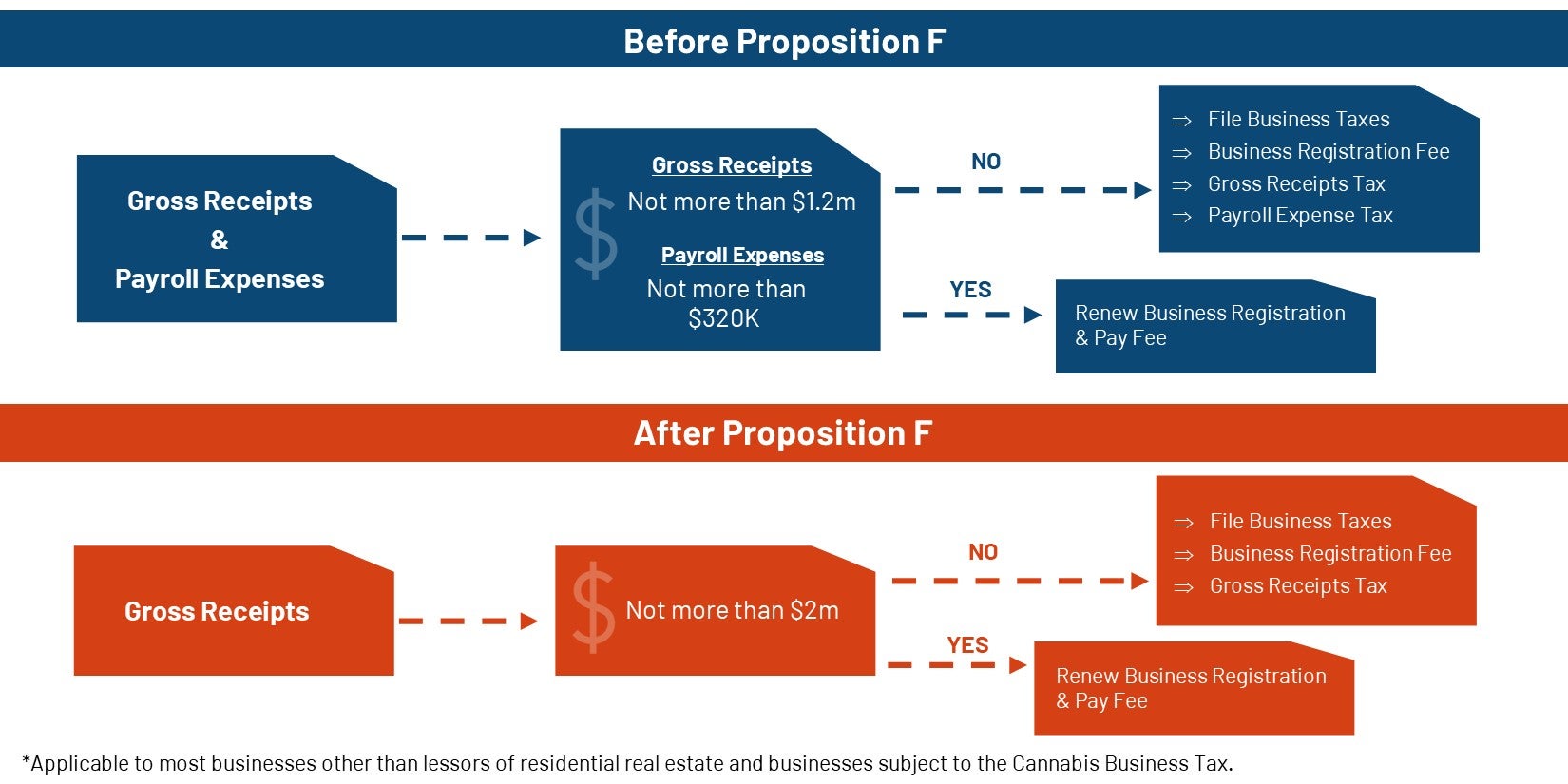

San francisco gross receipts tax estimated payments Friday February 18 2022 Edit. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. 11 With the passage of Proposition F for the safe harbor to apply the quarterly.

Fourth quarter 2016 estimated tax installment and annual gross receipts tax return for the 2016 calendar year Due February 28 2017. Businesses exempt from the Citys gross receipts tax due to being a small business enterprise are exempt from the pay ratio tax. The Homelessness Gross Receipts Tax effective January 1 2019 imposes an additional gross receipts tax of 0175 to 069 on combined taxable gross receipts over 50 million.

HRGT imposed additional business taxes to create a dedicated fund to support services for homeless people and prevent homelessness including one tax of 0175 to 069 on gross receipts over 50 million that a business receives in San Francisco and another tax of 15 on certain administrative offices payroll expense in San Francisco. The due dates for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement are the last days in April July and October respectively. Residential Landlords with no more than 2000000 in gross receipts in 2021 are exempt from estimated quarterly business tax payments in 2022 and if their gross receipts in 2021 were less than or equal to 2000000 will not receive an estimated business tax payment notice.

Businesses will pay the payroll tax for the last time in 2017 and begin paying only the gross receipts tax in its place in 2018. Due Dates for Quarterly Installment Payments. Estimated business tax payments are due april 30th july 31st and october 31st.

Quarterly estimated tax payments of weird Gross Receipts Tax Payroll. For tax year 2017 the gross receipts tax rates range from. The levy was estimated to.

An EDD representative may call employers as well as claimants to resolve eligibility issues. This tax adds to san franciscos broader gross receipts tax which applies rates ranging from 016 percent to 065 percent for firms with more than 1 million in gross receipts. The rate changes will also impact the quarterly estimated tax payments calculations available under the current safe harbor provision.

If you operate a business in San Francisco the deadline for filing and paying the second installment of your 2014 estimated Payroll and Gross Receipts tax is due on July 31 2014. The statutory due dates are April 30 July 31 and October 31. These quarterly estimated tax liabilities may be paid.

Lean more on how to submit these installments online to comply with the Citys business and tax regulation. There are seven different tax rates based on different business activities see below for a summary of the business activity categories. For registration years after June 30 2015 annual fees are determined by gross receipts from the prior year and fees can range from 90 to a maximum of 35000 for companies with gross receipts over 200M in the prior year.

Second quarter 2016 estimated gross receipts tax installment Due August 1 2016. Vessel Property Statements due. The fees range from 15000 to 35000 for companies with payroll expenses over 20M.

Under the new tax model businesses with at least 1 million in gross receipts will pay rates adjusted annually for inflation of 0075 percent to 065 percent. The Business Tax and Fee Payment Portal provides a summary of unpaid tax license and fee obligations. Business license renewal due for the SF Office of the Treasurer and Tax Collector Department of Health Fire Department Police Department and Entertainment Commission.

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Pin On Because S T Just Got Real

New Time Saving Tax Reports Now Available On Premium Accounts Workingpoint

San Francisco Gross Receipts Tax

Estimated Payments And How To Avoid Penalties

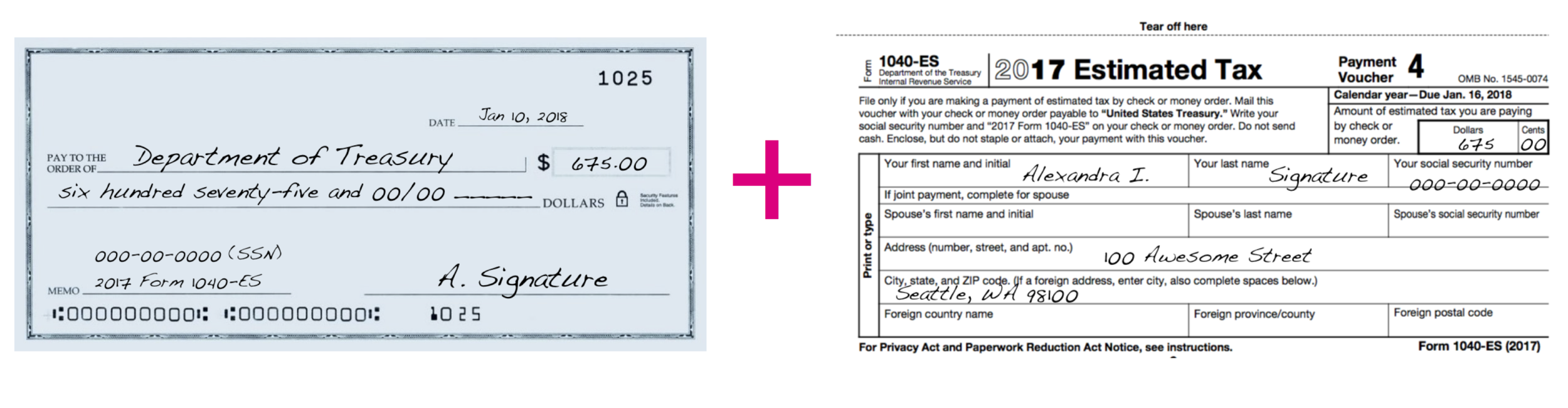

Work For Yourself Blog Seattle Business Apothecary Resource Center For Self Employed Women

Form 1040 Es Estimated Tax For Individuals

Quarterly Tax Calculator Calculate Estimated Taxes

What Happens If You Miss A Quarterly Estimated Tax Payment

Eq Blog Seattle Business Apothecary Resource Center For Self Employed Women

How Much Should I Set Aside For Taxes 1099

Form 1040 Es Estimated Tax For Individuals

2020 Form 1040 Es Payment Voucher

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

California Tax Forms H R Block

Work For Yourself Blog Seattle Business Apothecary Resource Center For Self Employed Women